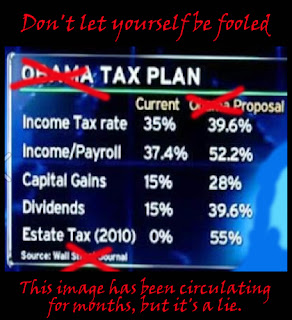

Taxes are complicated. Lies are simple

Taxation is a complicated issue. Americans seeking to understand it are not helped by false statements and graphics like this one (dating back to at least July).

I checked around, and I see no record in the Wall Street Journal of these tax increases being attributed to President Obama's tax proposal. That's because the Wall Street Journal did not make these statements and would not make these statements, because they are entirely baseless and false. I've run through the statements contained in the graphic below to trace their origin and provide more accurate information.

Some of the numbers in the image come from a projection of what MAY happen to the very top income brackets if CONGRESS allows all the Bush Era tax cuts to expire at the end of the year. Some of the numbers frankly come out of thin air and have no basis in fact. I looked closely at the Wall Street Journal and provide data from a couple of news articles ("More uncertainty for 2013" Feb. 18; "Obama intensifies tax fight" July 9). I also consulted Forbes ("The Truth about the Obama Tax Hike Proposal" July 20) and the WSJ column written by Michael J. Boskin in July that seems to have triggered a great deal of misunderstanding (and perhaps the graphic itself).

"Income tax rate 35% to 39.6%"

The Bush Era tax cuts are due to expire at year-end. Those cuts lowered the top tax rate to 35%. President Obama wants to retain all the cuts for 98% of Americans (97% of small business owners) and allow the taxes to return to their pre-Bush (strong economy) levels for those earning more than a quarter million dollars a year. BUT, the increased rate would only apply to the dollars earned over the quarter-million-dollar threshold (a $300,000-earning household would pay $199 more than now). A "Buffet Rule" would ensure that Americans earning $1 million or more each year paid a tax rate of no less than 30%, regardless of their income source.

"Income/Payroll 37.4% to 52.2%"

This apparently is some sort of theoretical combination of income tax and payroll deductions for Social Security and Medicare in the year 2016 - apparently a product of Wall Street Journal columnist Michael J. Boskin (he actually went on to add in hypothetical state payroll deductions to come up with a number closer to 70%). For the record, President Obama supported the lowering of federal payroll deductions. Those cuts and other tax reductions have saved typical middle class families $3,600 during his Administration. The "Boskin formula" is based on a hypothetical federal budget for 2016, an expiration of ALL the current cuts in taxes and payroll deductions in addition to an utter neglect of the fact that top income earners DO NOT PAY Social Security on all of their income. Social Security payments are only made on the first $106,000 of income. (So, adding a full Social Security deduction to the top income tax rate of those making hundreds of thousands to millions per year is not only dishonest, it's stupid.)

"Capital Gains 15% to 28%"

The Capital Gains tax will automatically rise with the expiration of tax cuts at the end of this year - if that happens. The highest bracket tax will climb from 15% to 20%. There is no proposal for an increase to 28% The President's proposal would retain the 15% level for taxpayers earning under $250,000 a year in capital gains income and set a 20% rate for higher earnings.

"Dividends 15% to 39.6%"

With the expiration of the tax cuts, qualified dividends will be taxed as ordinary income again. The very top rate of that tax will return to the 39.6% level (the rates would be 15%, 28%, 31%, 36% and 39.6%). The President's proposal would keep the 15% level for everyone except those in the top two income brackets.

"Estate Tax (2010) 0% to 55%"

HOLD ON! The estate tax was 0% in 2010 as a temporary one-year "repeal" of the tax. To compare the 0% in 2010 to a hypothetical 55% is ridiculous. The current (2011) estate tax is 35%, with an individual exemption of $5 million. That means, if the estate is valued at $5 million or less (that would be almost all estates), there is no estate tax and richer estates pay 35% of the value over $5 million. At year-end, that will automatically change back to a pre-Bush level of 55% with an exemption of just $1 million (estates under a million - that's still almost all of them - pay zero and the rest pay 55% of the amount over $1 million). But these numbers have nothing to do with a proposal by President Obama. Under the President's tax proposal, only the 0.3% (three tenths of one percent) most valuable estates - those valued at more than $3.5 million - would be subjected to ANY estate tax at all, and the top rate for the estate tax would be set at 45%.

Comments

Post a Comment